Ensuring solvency

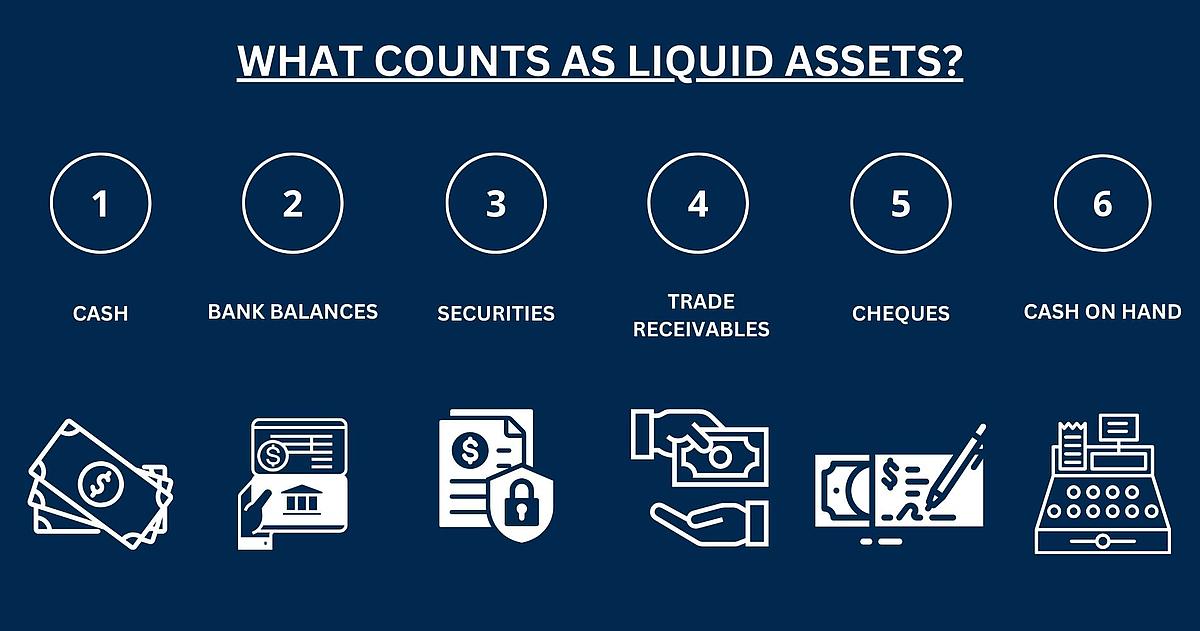

Careful liquidity planning ensures that a company is able to settle its short-term liabilities at all times. This prevents payment defaults, which can lead to a loss of confidence among suppliers and customers as well as legal consequences.

Avoidance of financial bottlenecks

By forecasting and monitoring future cash inflows and outflows, a company can identify potential financial bottlenecks at an early stage and take appropriate measures to avoid them. This can include taking out short-term loans or reallocating assets.

Optimizing the cash flow

Effective liquidity planning helps to optimize cash flow by ensuring that sufficient funds are available for operating expenses, investments and unexpected expenses. This contributes to the stability and efficiency of business operations.

Support for strategic decisions

Liquidity planning provides valuable insight into a company's financial position and supports management in making strategic decisions. This includes investments, expansion, acquisitions and the introduction of new products or services.

Improving creditworthiness

Well-planned liquidity management shows lenders and investors that the company has its finances under control, which can lead to better credit terms and easier access to financing.

Preparing for unexpected events

By planning and building up liquidity reserves, a company is better prepared for unexpected events such as market changes, economic crises or sudden drops in revenue. This increases the company's resilience and long-term survival.

Efficient use of resources

By continuously monitoring and adjusting liquidity, a company can ensure that surplus funds are used efficiently, whether by investing in profitable projects or reducing debt.

Avoidance of expensive emergency financing

Good liquidity planning can prevent the need for expensive emergency financing, which is often associated with high interest rates and unfavorable terms. This saves costs and protects the financial health of the company.